John Tierney tells us that investing in Chilean mutual funds is safer than investing in Treasury bonds backed by the full faith and credit of the United States.*

Charles Krauthammer doubles our dosage of antipsychotics and sets the shock dial to 11, snarling that treatments will not stop until we admit the file cabinet is filled with worthless IOUs.

And David Brooks celebrates indexing benefits as if it were the cure for "his friend's" genital herpes.

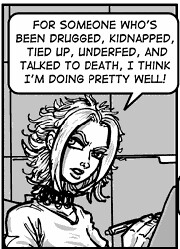

I'm not bouncing back as fast as I used to from these columns. But then I found comfort in a most unexpected place -- Business Week.

Trouble is, the President, in his guise as Salesman-in-Chief, may have done too good a job raising alarms about Social Security's imminent implosion. ``Bush said, 'We're going to have a crisis,' and offered private accounts as part of the solution,'' says James K. Glassman, an American Enterprise Institute scholar. ``But the two things are really separate, and the President was never able to make a connection between them.'' What's more, the crisis-mongering only served to heighten anxiety among the risk-averse cohort.(emph added)Based on my experience firmly lodged in the top percentile of the most risk-averse people on the planet, I could have told them that would happen.

What's more, Bush is even scaring the young ones, according to a recent (late March) poll:

Young adults have been the strongest supporters of the proposal for months. Support among those 18-29 dipped from seven in 10 to just under half, according to the poll by the Pew Research Center for the People & the Press. A quarter of young adults now say they're not sure how they feel about such personal accounts.Arbusto!

*Update: Media Matters explores Tierney's superficial infatuation with the Chilean system more closely.

No comments:

Post a Comment